PETALING JAYA: Despite the contraction in the number of housing units launched, properties within the price segment of RM500,000 and below experienced a jump to 65% in the first half of the year from 52% recorded in the second half of 2017.

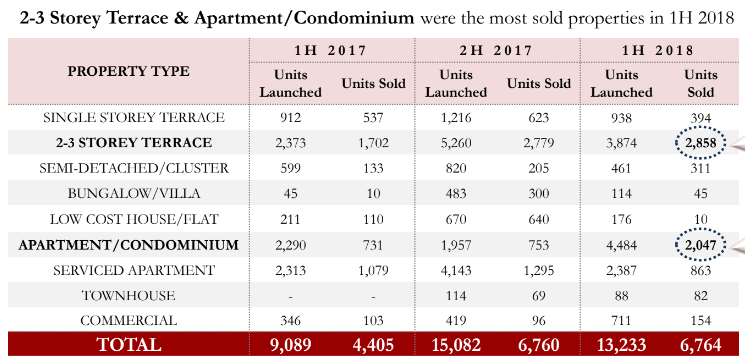

According to the REHDA Property Industry Survey 1H 2018, most respondents reported having launched properties in 1H 2018 (1H 2018: 40%; 2H 2017: 34%) albeit the number of units launched experienced a 12% contraction (H1 2018: 13,233; H2 2017: 15,082).

The data also showed that although launches experienced a reduction, sales performance, on the other hand, grew by 6%. The data collected is from 152 REHDA members from 12 states in Peninsular Malaysia who participated in the survey.

The average selling price by most states was in the range of RM100,001 – RM500,000 except for Kuala Lumpur and Selangor (RM500,001 – RM700,000). Apartments and condominiums overtook two to three storey terrace houses as the most launched residential property type in the country.

However, in sales terms, out of the total of 6,764 units sold, two-to-three storey terrace houses took the lead with 2,858 units, followed by apartments and condominiums (2,047 units).

Most of the landed homes sold were located in Sepang and Shah Alam while the high-rise homes were from Cheras and Segambut.

Buyers’ composition is made up of 3% foreigners and 97% local buyers

Buyers’ composition is made up of 3% foreigners and 97% local buyers

First-time house buyers continued to make up the majority of purchasers with 46% compared to 43% in the second half of last year. According to the survey, 42% of the buyers bought houses for self-dwelling while 35% were purchasing for their family members.

Affordability

The percentage of respondents reported to have affordable housing components in their development has increased for the first half of the year (47%) compared to the same period in the previous year (37%).

Top three suggestions from the respondents to encourage the provision of affordable housing were a reduction of development charges, lower land conversion premium and exemption of capital contribution.

Unsold Units Price range of unsold units (residential and commercial)

Price range of unsold units (residential and commercial)

The percentage of respondents with unsold units increased from 66% in 2H 2017 to 75% in 1H 2018, with a majority having up to 30% unsold stock.

Most of the unsold units appeared to be equally distributed within the price ranges of RM250,001 to RM500,000 (mostly in Kuantan and Alor Setar), RM500,001 – RM700,000 (mostly Johor Bahru and Shah Alam) and RM700,001 – RM1mil (mostly Johor Bahru and Puchong).

According to the survey, end-financing and unreleased Bumiputera units remained the two major issues for unsold units. Respondents facing end-financing problems increased to 89% in 1H 2018, and 39% of the loan rejections were for properties priced RM500,000 and below.

Contributing factors to the financing issue include a lower margin of financing offered, ineligibility due to buyers’ income and adverse credit history.

Future Launches and Outlook for 2H 2018 and 1H 2019

93% of the respondents were reported to be affected by the current economic scenario with compliance costs remaining the top factor affecting developers’ cash flow in both 2H 2017 and 1H 2018. It is followed by material and labour cost as well as land cost.

Respondents also noted that the overall costs increase of doing business have gone up to 8% (2H 2017: 6%).

Affected respondents have taken various measures to boost sales, among them are by assisting buyers with the 10% down payment for their house purchase. Other methods include the enhancement of products via innovation and creativity.

Nearly half of the respondents planned to launch in 2H 2018 with a total of 15,852 units comprising 8,991 strata units, 6,433 landed units and 428 commercial units. However, 2/3 of them expected their sales performance to be 50% and below.

Most of the states will be launching properties in the RM100,001 – RM500,000 price range except for Penang and Selangor (RM500,001 – RM700,000).

In general, the majority of respondents were neutral towards the economic and property industry outlook for 2018. Despite this, things are expected to be rosy for next year as more respondents are optimistic about the market in 2019.

Contributing factors to the financing issue include a lower margin of financing offered, ineligibility due to buyers’ income and adverse credit history.