Buying a house isn't easy. Sometimes

you can feel like a dizzying set of guidelines and procedures, especially now

banks have tightened up their lending rules as non-performing loans have

increased. Because of this, it's important to find out why your loan

application was denied. Here are some common reasons why your loan request can

be denied.

1.

Application Scoring Systems

The banking industry has embraced the

use of advanced technologies to serve its customers more quickly and with

greater accuracy. One of the major changes that has occurred in the banking

industry is the utilization of computers to underwrite mortgage loans. In the

past, traditional underwriting process was performed by humans. However, as

with many functions, computers can perform these functions faster, more

accurately, and can also reduce human error or negligence in the underwriting

process.

Application scoring is a system used

by banks to determine the risk grade and decide how much to lend to customer.

Whenever the bank officer receives a loan request, they will enter customer's

personal information into the application scoring system, which analyses the

customer's profile such as customer's age, education level, marital status,

occupation, income, nature of business, etc.

Each fact will be given points based

on information that have provided by applicant, all the points are added

together to give a score. Different banks have different underwriting

guidelines to work out application scores.

a) Occupation

There are a number of factors that a

financial institution will take into account when they consider your

application for a mortgage loan, and it has been proven that occupation has

been one of the important factors when evaluating your loan application.

In numerous sectors of the employment,

we can say that an organizational structure is broadly divided into two major

categories as white collar and blue collar workers. The following are the

differences between white collar and blue collar workers:

White collar worker - Person who performs professional,

managerial, or administrative works e.g. manager, administrative executive,

engineer, doctor, lawyer, pharmacist, appraiser, pilot, judge, accountant,

university lecturer, etc

Blue collar worker - Person who performs manual labor

works at the work place, e.g. technician, restaurant cook, driver, waiter,

manufacturing or production operator, maintenance worker, constructions worker,

installation or repair worker, gardener, beautician, hairstylist, etc.

b) Nature of the business

Banks will look at the sector or

industry you are employed and whether is it especially exposed in economic

recession. And also the overall market conditions or fluctuation may affect

certain sectors or industries such as oil & gas, transport & logistics,

airline, etc.

It is worth mentioning that there are

some of the borrowers from certain sectors or industries had a poor payment

records in the banking system, so banks will reject the loan application if

there is a loan request from the same sectors or industries, based on past

history summary and analysis.

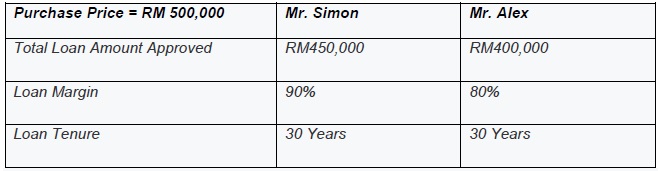

Case 1:

Mr. Simon (white

collar worker) and Mr. Alex (blue collar worker) are applying for a mortgage

loan to purchase a property at the same time to the same bank, and had the same

income. Each bank has their own specific criteria for who they are willing to

lend to and bank has a guideline of calculating the scores, so it could be under

two different results as below:

This is because some of the banks

believe that if there is a financial crisis or global recession occurs, the

white collar workers are more confident to find a new job, and it’s also

according to statistical analysis based on past banking data.

Remark: Employment stability is important as

most banks prefer borrowers to be with their current employment for at least

three or six months and not on a probationary period if possible.

(adsbygoogle = window.adsbygoogle || []).push({});

2. Personal Credit Report (CCRIS)

CCRIS stands for Central Credit

Reference Information System created by Bank Negara Malaysia (BNM). All

participating financial institutions in Malaysia are required to submit a

monthly credit report of all their borrowers to the Credit Bureau Malaysia, all

the credit information that have been collected is stored in a computerized

database system known as the Central Credit Reference Information System

(CCRIS) which contains credit information on about 9 million borrowers in

Malaysia.

CCRIS automatically processes the

credit information received from the participating financial institutions and

compile it into reports consistently, make it available to the financial

institutions upon request.

a) A CCRIS report consists of the following credit information:

(i) Outstanding Credit:

- All credit facilities information

including outstanding balances and credit limits (e.g. home loan, credit card,

hire purchase, personal loan, etc),

- Payment history records but only the

last 12 months of payments appear in credit report (fully settled credit

facilities are excluded from the report.)

(ii) Special Attention

Account

(iii) Application for

Credit:

- All applications made in the past 12

months

CCRIS report is a summary of your

credit payment history and banks will use your CCRIS report when evaluating

your credit risk and deciding whether or not to approve you for loan.

b) Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN)

There are a total of 1.25 million

borrowers who failed to repay their PTPTN loans have been listed on CCRIS

beginning 2015. If you don’t pay your PTPTN loan, it can quickly damage your

credit score. A good credit score record can make it possible to buy your dream

home or car, so the best way you can do is make payment on time to improve your

credit scores.

c) Special Attention Account

Credit facilities under the close

supervision or monitoring by the financial institutions, such as Non-Performing

Loan (NPL) or credit facilities under the AKPK’s Debt Management Program (DMP).

AKPK stands for Agensi Kaunseling dan

Pengurusan Kredit, also known as Credit Counselling and Debt Management Agency.

An agency was set up by Bank Negara Malaysia (BNM) to help individuals who are

facing difficulties servicing their outstanding debts as well as financial

counselling help individuals take control of their financial situation and gain

peace of mind that comes from the wise use of credit.

The AKPK counsellors will work with

the borrowers to develop a personalized debt repayment plan and resolve

financial problems with the financial institutions.

Generally speaking, bank will not

approve application for those under Special Attention Account.

d) No payment history on CCRIS (Zero CCRIS)

If you do not have any payment history

record, it can affect your credit score. This may seem unfair, but the reason

is that you have not established past payment history to show that you have the

discipline to make payment, banks look for a consistent history of paying your

loan on time.

Case 1:

Mr. Lee began his

career as a software engineer for a multinational company after graduation. He

has been promoted to manager within a short period of time, his monthly salary

has been increased from RM 3,500 to RM 6,000, and he started making enough

money to splurge. Meanwhile, he has three credit cards with higher credit

limits, and he started spending money on luxury products and unnecessary

things. Because of his attitude, he's owed more than RM 30,000 within a year

and failed to make the credit cards payment on time.

One year later, Mr.

Lee and his wife decided to buy an apartment, they have applied loans with

different banks. Unfortunately, all applications have been turned down because

of an unsatisfactory credit history.

Case 2:

Madam Chen has more

than 10 years of experience in the stationary trading business, and she intends

to expand her business into other areas. However Madam Chen needs some extra

cash to increase her capital and to expand her business, thus she decided to

apply for a loan from banks. One week later, she received a letter saying that

the loan has been denied. She was surprised by the result and was informed by

the loan officer that she has been blacklisted for being a guarantor to

borrower who defaulted on payments.

As cases mentioned above, we can

realize that it's so important to manage your creditworthiness, usually bank

will determine your creditworthiness based on your credit report. It's a good

idea to have your credit report before you start your loan application, so you

have time to find out and fix any mistakes on your credit report.

Check your credit report at http://www.propertyavenue.com.my/personal-credit-report/

3.

Debt Servicing Ratio (DSR)

Debt Servicing Ratio (DSR) is the

percentage of a borrower's monthly net income that is spent on debt payments,

and provides an estimate amount that you may be able to borrow. Banks use the

Debt Servicing Ratio to measure your ability to manage the debts, with a low

Debt Servicing Ratio shows you have a good balance between debt and income.

Banks want to make sure that you can afford to pay them back and you’re not

overwhelmed with too much debts before they give you a loan. This also may

reduce the bad debts or Non-Performing Loans (NPL) ratio.

To know your Debt

Servicing Ratio = Total Monthly Commitment /

Monthly Net Income

Each bank has its own set underwriting

criteria and guidelines to determine borrower’s net income and also maximum

allowable DSR, even if you’re rejected by one bank, but you might not be

rejected by others. For your information, you may refer to the guidelines as

below:

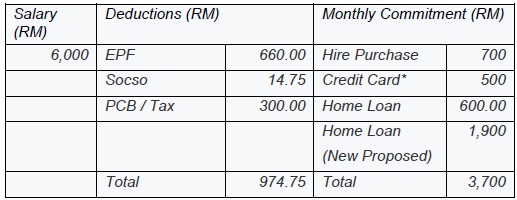

Examples:

Case 1:

Mr. Albert, Account

Officer.

Credit card

commitment calculation = Outstanding amount x 5%

DSR % = Commitment /

Net Income

Monthly Commitment:

RM 3,700

Monthly Net Income:

RM 5,025

DSR: 73.63 %

Mr. Albert mortgage

loan application results as below:

Bank M: Loan has been

rejected (DSR more than 70%)

Bank R: Loan has been

approved (DSR within guidelines, less than 75%)

4.

Income Documents and Supporting Documents

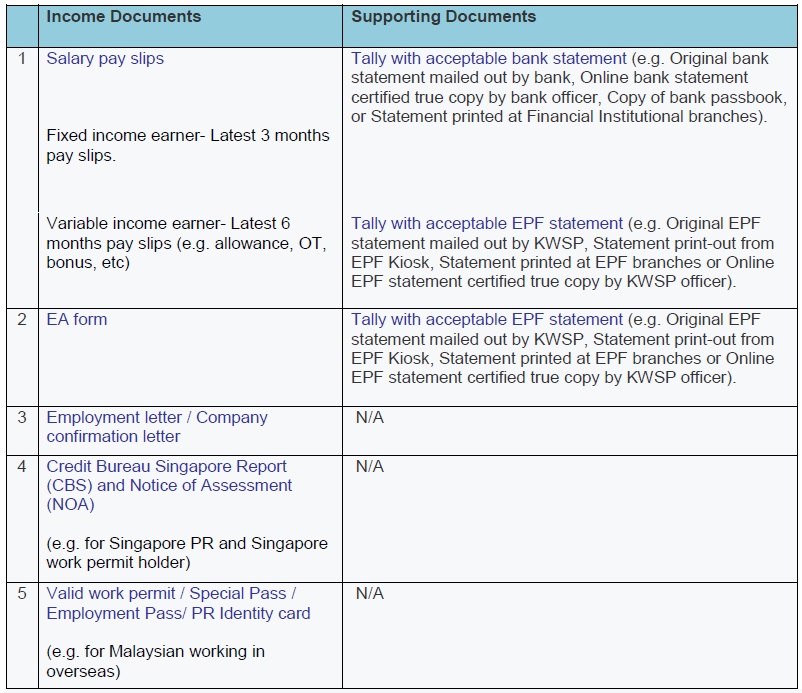

When applying for a mortgage loan,

banks will need proof of income to ensure that you have sufficient monthly

income to cover your mortgage loan payments and will consider your total

monthly income from all sources e.g. include salary, OT, bonus, allowance,

rental income, dividend, etc. Your current income will also be a significant

determining factor in loan approval.

Banks will want to see that you're

currently working, it is a very important step in determining the eligibility

for a loan. Most of the documentation should be similar if you have applied to

several banks, so you should prepare all your documents as early in the process

as possible.

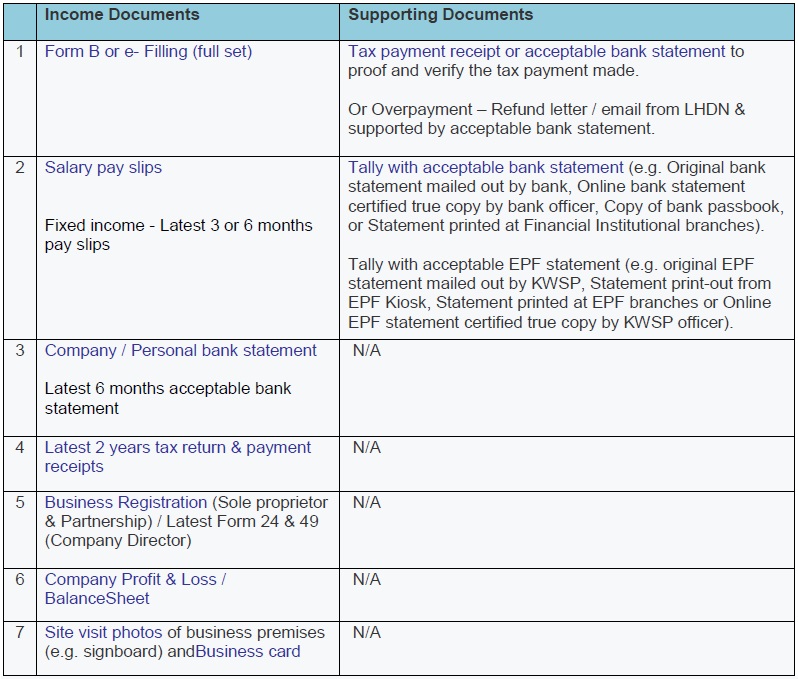

Below are some of the basic documents

that you’ll need to prepare to effectively get your loan.

If you’re employed,

you’ll also need to prepare the following documents:

If you’re self-employed,

you’ll also need to prepare the following documents:

Other / Additional

Income Documents:

5.

Bankruptcy

Bankruptcy is the legal procedure for

a person unable to pay off his outstanding debts of at least RM30, 000.00, it

is a status that can only be granted by court.

Once a person has become bankrupt

(bankruptcy order is made by the court), the Director General of Insolvency

(DGI) will become the administrator of his assets or properties, and will repay

or distribute fairly to the creditors once the assets or properties are sold.

Most of the banks would not even consider lending money to someone with

bankruptcy.

6.

Credit Information provided by Credit Reporting Agencies (CRA)

Banks might want more information than

just CCRIS banking payment history before approving a mortgage, including

credit information from third party data. Banks will carry out a credit

assessment of the borrower from various sources, such as credit information

provided by the Credit Reporting Agencies (CRA) registered under CRA Act,

namely RAM Credit Information Sdn Bhd, CTOS Data Systems Sdn Bhd, Credit Bureau

Malaysia Sdn Bhd, FIS Data Reference Sdn Bhd, BASIS Corporation Sdn Bhd and Dun

& Bradstreet (Malaysia) Sdn Bhd.

Credit Reporting Agency (CRA) is a

company that collects and analyzes credit related information on individual

consumers or on businesses for variety uses. The data are collected from

various sources, while CRA offer many services to the public and companies that

seek consumer information.

Lending industry is a risky business.

Basically, the lending institutions like banks, motor vehicle dealers,

telecommunication companies, and other creditors will use all available credit

information to help them make their lending decisions. Lenders will determine

your creditworthiness based on your credit report as they need to minimize risk

as much as they can.

The Credit Reporting Act 2010 promotes

fairness, accuracy and privacy in the practice of creditReporting, and you have

the right to access your credit report to verify the accuracy of information

reported in your credit report. For your information, the Credit Reporting

Agency is not allowed to contain information about the individual bankruptcy

status two years after the date of discharge of bankruptcy or the date of final

settlement.You may check your report from credit reporting companies.

Case 1:

Mr. Kumar graduated

from Aviation Maintenance Academy two years ago, and currently working as an

aircraft maintenance engineer. He decided to buy a house with his fiancée

before getting marriage. Unfortunately, his loan application has been declined,

and he found out that he has been blacklisted by a motorcycle dealer who offer

in-house finance to him. He purchased the motorcycle with that dealer when he

was studying at university, and he failed to make full payment to the dealer

after graduation.

Case 2:

Ms.Siti was unable to

get home loan because of her blacklisted status. She has been blacklisted by

telecommunication company due to there is an outstanding balance of RM 600 on

her account which registered since 2009. Finally, she had realized that her

brother used her name to register an account with that telecommunication

company.

Generally speaking,

it’s important to have a positive credit history, the better your credit

history, the more likely to lend you money.

7.

Developers& Sellers Background / Negative Factors & Area

Having a good credit score and stable

job or good income are the primary factors that banks will look for when you

apply for a mortgage, other than that, banks will also take into consideration

the developers and locations you have chosen.

a) Under Construction Property Projects

It's important to make sure you are

buying from a reputable developer as there’s threat of a developer failing to

complete construction (abandoned projects) within the timeframe.

For under construction property

projects, the developers are required to submit end-financing / empanelment (an

arrangement with a project developer to provide financing to the buyers)

documents to the banks that they wish to apply before banks can provide

financing to the buyers. In other words, the home buyers can only borrow money

from the approved end-financier or panel banks.

The main criteria or guidelines of

evaluating for end-financing / empanelment process would be:

- To have a background search on the

developer, and check any prior projects that they have built in the past,

- Company’s director profile search,

- Company financial status,

- Project viability and location,

- Project price assessment,

- Any negative factors may affect the

marketability of the projects, etc.

For those blacklisted developers had a

poor track record usually unable to get EF approval from banks. Some

problematic housing developers have been blacklisted by the Housing and Local

Government Ministry, you may check at: http://ehome.kpkt.gov.my/index.php/pages/view/43

b) Completed Property

Typically for sub sale or sub purchase

properties. The mortgage loan officer will seek for verbal opinionand obtain a

fair indicative market value from panel appraisal / valuer when receives a loan

request from borrower. If the property is close to the negative factors or in

the negative list area (each bank has their own listings), it will affect the

property market valuation. At the same time, banks will also consider the

following negative factors into account, such as:

- Facing junction,

- Close to oxidation pond, sewerage

pond, rubbish dump, grave yard, high-tension cable, etc,

- Flood prone area,

- Hill slopes area,

- Renovation or extension to the

property without local authority approval,

- Property structures (e.g. wooden or

half-brick houses),

- Leasehold properties with remaining

lease less than 40 years (different banks have different criteria)

- Other factors which may affect the

marketability of the property, etc.

Remark: If a seller is bankrupt or under

bankruptcy proceeding status, the loan also can be rejected, it is because the

court will appoint the Director General of Insolvency (DGI) to administer the

bankrupt’s assets or properties in order to settle the outstanding debts to his

creditors.